Borrowing Power is unique to TotallyMoney. In this guide, we’ll tell you exactly what it is, how it works, and how to build it to improve your eligibility for credit.

Here’s what you can expect:

What is Borrowing Power and how it’s calculated

What is eligibility and what lenders like to see

The link between Borrowing Power and eligibility

How you can increase your Borrowing Power and improve your eligibility

What is Borrowing Power?

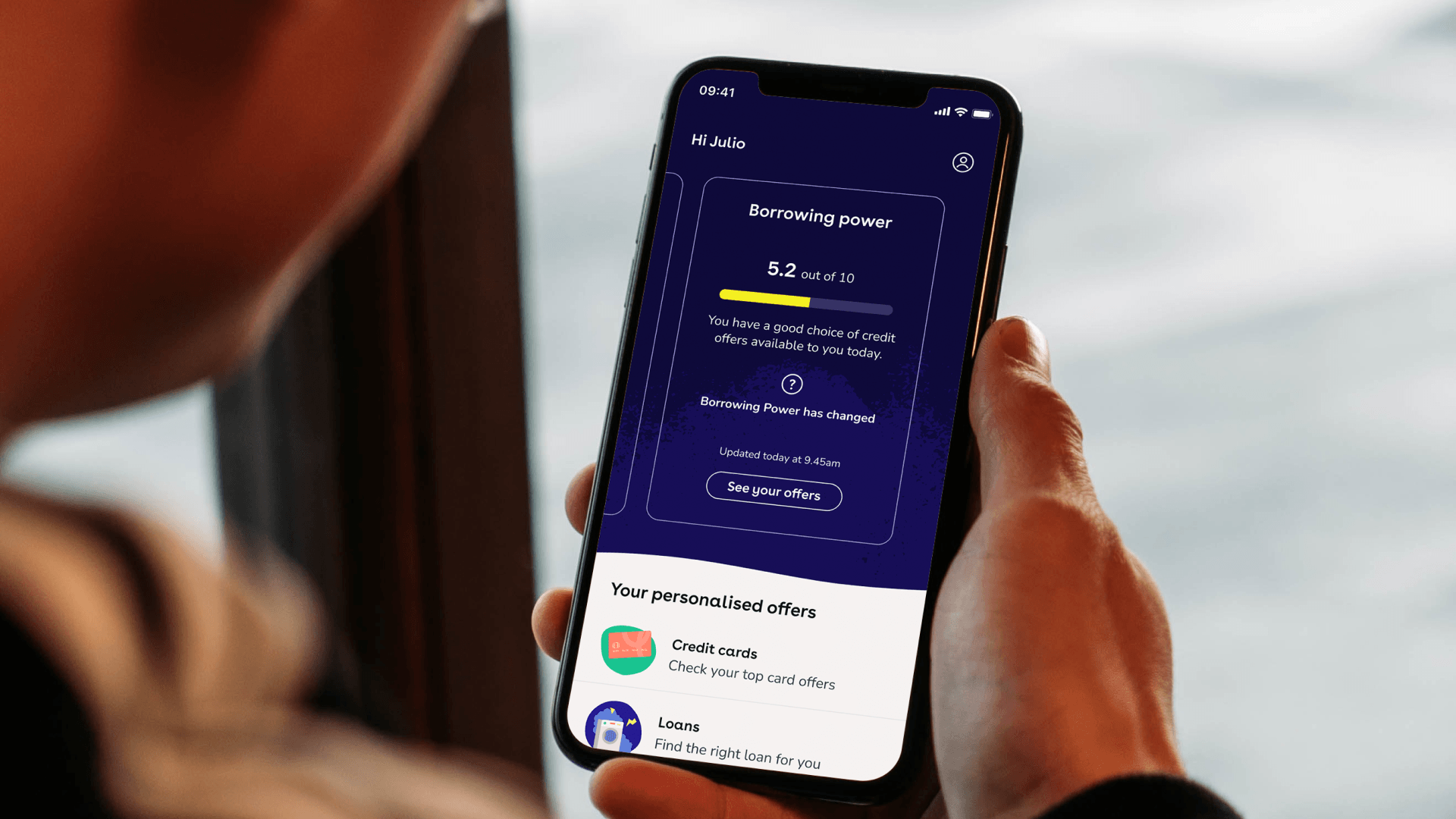

Borrowing Power is a number out of 10 that tells you how likely you are to be eligible for credit.

Eligibility is how likely you are to be accepted for credit. If you have a good eligibility, it means the lender thinks you’re someone who can responsibly borrow and repay money. Find out more about eligibility on TotallyMoney.

Borrowing Power is designed to give you an awareness of your eligibility. This means you know where you stand, and can work towards building and increasing your Borrowing Power. When you do, you’ll be able to see more personalised credit offers.

How is my Borrowing Power calculated?

Lots of data goes into creating your Borrowing Power. Here are some of the main things that make up your Borrowing Power:

The information you gave us when you signed up to TotallyMoney, such as your income and employment

Data about your credit profile from Experian

What lenders are looking for. We know the kind of thing lenders like to see in credit applications, so we take this into account

Some things make up your Borrowing Power that are outside of your control:

Live data about the credit market. This means your Borrowing Power might change, even if your personal circumstances are the same. For example, most people’s Borrowing Power decreased during coronavirus, as there were less offers available.

What is eligibility?

As mentioned, eligibility is how likely you are to be accepted for credit offers.

Previously, lenders wouldn’t tell anyone how they calculate someone's eligibility. Now that’s changed, and we know some of the things that the lender likes to see in an application.

With TotallyMoney, you can check your eligibility before you apply for a card or loan, and see how likely you are to be accepted.

💡 Did you know?

You could even be pre-approved for some offers. This means as long as all the information you gave us was accurate, and you pass the lender’s final checks, you’ll get the card or loan, plus the advertised interest rate.

Your eligibility with TotallyMoney will be more accurate if all the information we have about you is up-to-date, so update your account if anything changes.

You can see your eligibility for a specific offer as a percentage. For example, 90% means you have an excellent chance of being accepted, 50% means you have a good chance.

How do lenders calculate my eligibility?

Hundreds of different factors go into how a lender calculates your eligibility. Lenders will look at your credit report to get an overview of if you’re a responsible borrower.

The most important thing for them is to see that you’ve previously borrowed money and repaid it on time, through a loan, credit card, or mortgage. Or, that you can keep up with regular payments on energy bills or mobile phone contracts.

Here are some of the things lenders look at when calculating your eligibility:

Your income

Individual Voluntary Arrangements (IVA)

County Court Judgments (CCJ)

Missed payments

Age of your accounts

Your employment details

Your current credit limits

If you’re on the electoral register

How much credit you’re using (credit utilisation)

Lenders like to know you’re responsible with any money you borrow. The more you can show this, the more likely they are to lend to you.

Some lenders will use open banking to check your eligibility for credit. Open banking connects all your financial info together for a lender to see. That means they’ll look beyond your credit report, to get a wider picture of how you manage your money. So, if you handle your finances well — for example, always paying your rent on time — it could help your application.

Buy Now Pay Later (BNPL) services can also affect your eligibility for credit. These payment methods will be added to credit reports this year, and lenders will be able to see how frequently you use these services, and if you’ve ever missed a payment.

How you can influence your Borrowing Power and eligibility

💡 Did you know?

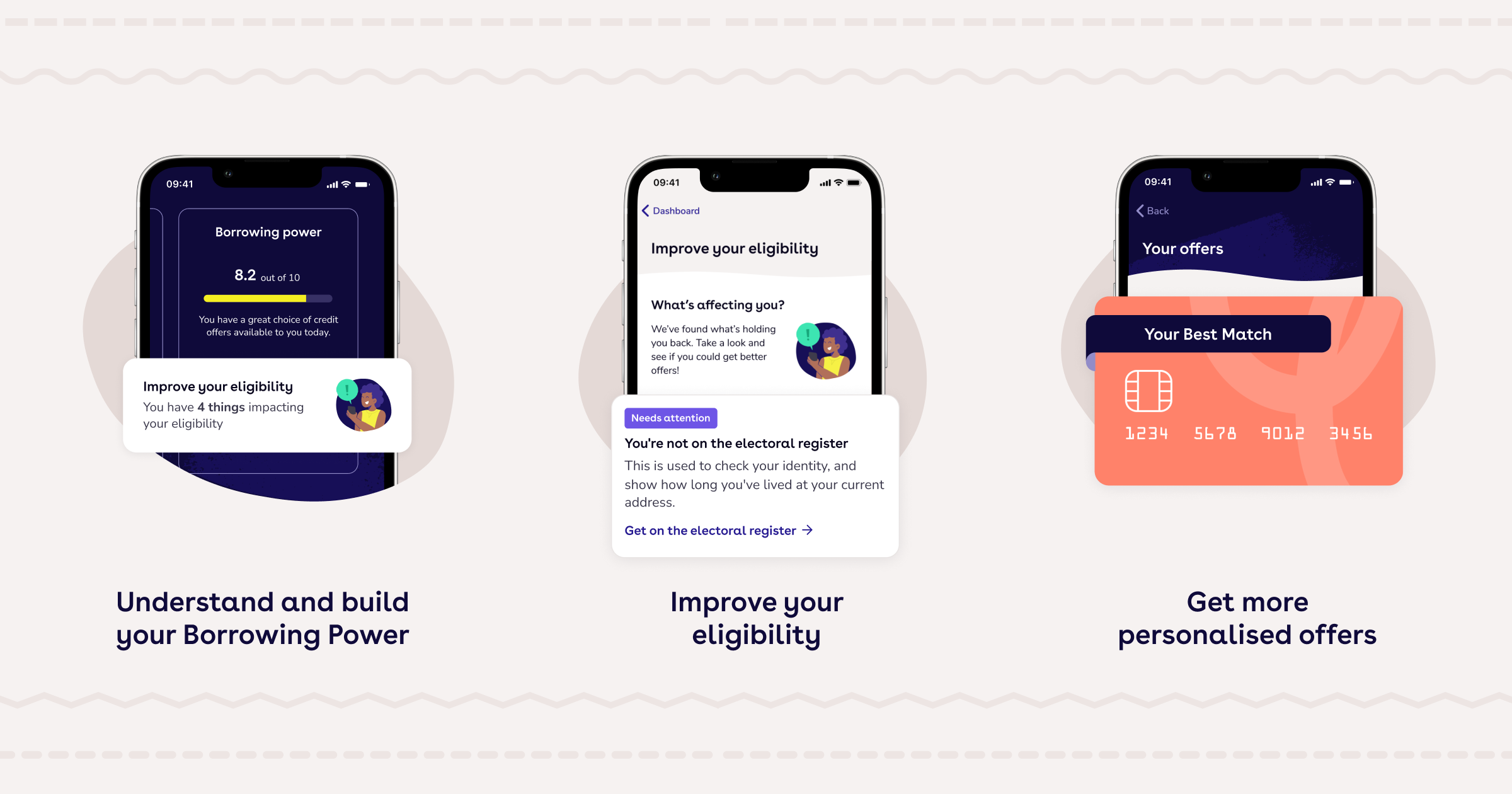

You can now see what you can do to improve your eligibility in the TotallyMoney app. Discover what’s holding you back from the best offers and see the actions you can take to improve.

Your financial behaviour affects your Borrowing Power and eligibility. By increasing your Borrowing Power, your eligibility will improve.

Good financial habits such as making payments on time and not going beyond your credit limit can have a big impact.

How can I increase my Borrowing Power and improve my eligibility?

Here are some of the main actions you can take to increase your Borrowing Power:

Check your TotallyMoney account to make sure your income and employment status are up-to-date

Satisfy any outstanding CCJs

Never miss a repayment. Always pay credit agreements such as credit cards, mobile phone contracts, loans and mortgages on time

Use less than 25% of your available credit card limit, and your total available credit, For example, if your maximum credit limit across 3 credit cards is £4,000, try to keep your usage to under £1,000.

Get on the electoral register as this will help lenders to confirm your identity

Avoid opening more than 2 accounts in 6 months

We know some of these can be difficult, but doing them can increase your Borrowing Power. When it does, so will your eligibility for credit offers.

Remember, there are some things that are out of your control with Borrowing Power, such as changes in the credit market. This means it can go up and down more often than your credit score.

💡 Helpful tip

You can check your eligibility for cards and loans as many times as you want, for free. This will have no impact on your credit score as these are only soft searches.

How can I find my personal offers?

Log in to your TotallyMoney account and make sure all of your details are up-to-date. This will give you the most accurate results.

Then, head to your offers page and check your Borrowing Power, alongside what offers we think you could be eligible for.