Privacy Notice

1.

Introduction

We value your privacy. We want to be accountable and fair to you and transparent about how we collect and use your personal data.

This privacy notice tells you what to expect when we collect and use personal data about you. It applies to all users of our website www.totallymoney.com and the TotallyMoney app, including members of our customer panel.

You should also read our Terms and Conditions and Cookie Policy carefully before you decide to use our services.

Any changes we make to this privacy notice will be posted on this page, so please check back frequently.

This privacy notice applies only to the personal data that we collect in relation to our services. Our website may contain links to and from third party websites. For example, we may link to and from the websites of lenders, other credit brokers or insurance intermediaries, credit reference agencies, our partners, advertisers or affiliates. We can’t be responsible for personal data that these third parties collect, store and use through their website without our involvement. You should always read the privacy notice of each website you visit carefully and before you submit any personal data to them.

When you sign up for a TotallyMoney account we will ask you for information that helps us provide you with our services. Where this information is mandatory, we will make this clear in the sign up journey. Some of this information is also needed to help us or our partners meet their legal and regulatory obligations (e.g. for anti-fraud checking or to check that you can afford certain credit products before offering them to you). If you do not wish to provide this mandatory information, you will not be able to use our services.

2.

Who we are

We are TotallyMoney Limited. We own and operate the free credit report and personalised consumer credit website, www.totallymoney.com, and the TotallyMoney app. We provide a range of services to help you better understand and improve your financial situation.

Depending on which of our services you use, we may act as an independent credit broker or insurance intermediary. We are not a lender or an insurance provider. Further information about our services can be found in our Terms and Conditions.

TotallyMoney Limited is a company registered in England (No. 06205695), with VAT number 974859255. Our registered office address: 5th Floor, Halo, Counterslip, Bristol, BS1 6AJ and trading office address: White Collar Factory, 1 Old Street Yard, London EC1Y 2AS.

TotallyMoney Limited is an Appointed Representative of TM Connect Limited, which is registered in England and Wales (Company Registration Number 06967012, FCA FRN 511936). TM Connect Limited is authorised and regulated by the Financial Conduct Authority in respect of:

Credit broking

Providing credit information services

Mortgage arranging

Insurance mediation activity

TotallyMoney Limited is also a registered agent of Bud Financial Limited (“Bud”), our open banking partner. Bud is registered in England and Wales (Company Registration Number 09651629, FCA FRN 793327). Bud is authorised and regulated by the Financial Conduct Authority in respect of payment services. For more information about our open banking services, please see section 5.15 below.

You can check the Financial Services Register by visiting the FCA website. We also provide an energy comparison and switching service, which is not an FCA regulated activity.

Data protection law applies to our collection and use of personal data and TotallyMoney Limited is the controller of that personal data (ICO Registration Number Z1096594).

If you have any questions about this privacy notice, please contact us or email us at [email protected]. If you wish to contact our Data Protection Officer you can email them at [email protected] , or you can write to them at White Collar Factory, 1 Old Street Yard, London EC1Y 2AS.

3.

What data we collect about you

Personal data is data that relates to an individual. The individual must be identified or identifiable. This means that anonymous data is not personal data. We may collect, use and store different kinds of personal data about you. In some circumstances, we may transfer your data to third parties (see section 7 of this privacy notice How we share your personal data with others).

In this privacy notice we’ve used the following definitions to refer to some of this data:

Account data includes:

the basic information you provide when you sign up to use our services (e.g. first name, last name, date of birth, postcode, address details, residential status, employment status, annual income, phone number, email address and password);

any additional ‘affordability information’ you give us (e.g. marital status, additional household income, monthly rent or mortgage cost, how many people depend on you financially, monthly cost of childcare and dependent support); and

any information you give us about your job (e.g. job title, industry and/or company name).

It’s vital that you keep your account data accurate and up to date, because inaccurate personal data will produce inaccurate results. You can update your information in the "My Details" section of your account, and we sometimes will give you a nudge to do so when you log in. If you’re not sure how to update your information, please contact us –[email protected].

Credit report data means information about your credit file given to us by TransUnion (see section 7.1 for more details).

Credit score data means information about your credit score given to us by TransUnion (see section 7.1 for more details).

Eligibility data means information about your eligibility for the types of credit products featured on our website, such as your likelihood of being accepted for a particular credit product and the actual or indicative rates of interest and term of borrowing that will apply. Eligibility data includes:

data given to us by Experian, who perform eligibility checks on our behalf;

data given to us by the lenders and credit brokers with whom we perform direct eligibility checks; and

data we generate about your likelihood of being able to access credit, based on the information we hold on you.

See section 7 for more information about how we share your personal data with Experian and with our panel of lenders and brokers.

Energy profile data means information:

that you give us when you use our energy comparison and switching service; or

that Decision Technologies Limited (“Decision Tech”), our energy comparison and switching service provider, gives us when you use our energy comparison and switching service (see section 7.4 for more details).

Your energy profile data includes information about:

your current energy supplier;

the energy tariff you are on;

your energy usage;

your energy meters (i.e. meter type and meter numbers); and

your energy payment method (e.g. pre-pay or otherwise).

If you chose to switch energy with us, your energy profile data will include the current status of your switch (e.g. pending or completed, date of your last switch etc.).

Energy results means information about your potential energy savings and the energy tariffs that are available to you.

Marketing data means your marketing preferences (i.e. whether you have opted in or out of receiving marketing messages from us).

Offer data means information about:

offers made to you by lenders in response to a specific enquiry; and

further details of what we presented and how, if at all, you interacted with, offers made to you.

Open banking data means the status of your open banking connection and data that we receive if you choose to connect your bank or building society account to your TotallyMoney account using our open banking partner Bud. Open banking data includes your account details, information about transactions and balance data.

Product application data means data about the outcome of product applications you make as a result of using our services, which is given to us by some lenders, lender’s agents and third party brokers or insurance intermediaries and by our energy comparison and switching service provider. We may use this data to:

calculate the commissions that we are due;

to personalise the service to you;

to send you service messages (for example, if an energy supplier declines your application to switch, we will email you to tell you why, and what to do next);

to help us understand our customers, to improve our service and to inform our marketing strategy (i.e. research and development and business insight).

Service-specific data means additional data that you or our partners give us, over and above account data, when you use a particular service. For example, information about your car that you give us when using our car insurance comparison service.

Technical and behavioural data means details of your visits to the website or app including the actual pages you visit, IP address (from which we may derive your location) and details of the resources that you access, as well as your interaction with messages (e.g. whether or not you have opened an email from us). We also capture information about your computer or device including, where available, your operating system and browser type.

We also collect, use and share aggregated data such as statistical or demographic data. Aggregated data may be derived from your personal data but is not considered personal data in law as this data will not directly or indirectly reveal your identity. For example, we may aggregate your usage data to calculate the percentage of users accessing a specific website feature. However, if we combine or connect aggregated data with your personal data so that it can directly or indirectly identify you, we treat the combined data as personal data which will be used in accordance with this privacy notice.

4.

How we collect your data

We use different methods to collect data from and about you, including:

Direct interactions. You may give us your personal data by filling in forms or by corresponding with us. This includes personal data you provide when you:

sign up for a TotallyMoney account;

use our service to compare particular products;

contact us (for example by post, phone, email or via our website or app);

give us feedback; or

enter a competition, promotion or survey.

Credit reference agencies. The credit reference agencies that we work with will give us eligibility data, credit score data and credit report data.

Partners. The partners that we work with such as credit issuers, credit brokers, insurance intermediaries or other service providers (referred to collectively in this privacy notice as “partners”) give us eligibility data and, in some cases, product application data.

Automated technologies or interactions. We’ll automatically collect technical and behavioural data as you interact with our website or app. For example, we use cookies and other similar technologies (e.g. pixels) to tell us which area of the website you have visited and which products you have clicked out on. For more information on how we use Cookies and similar technologies, please read our Cookie Policy.

TM Connect Limited. Our sister company, TM Connect Limited, gives us marketing data if you agree to receive marketing from us when you apply for a product that TM Connect Limited promotes.

Decision Tech and Decision Tech’s suppliers give us energy profile data and energy results.

Bud. Bud is our open banking partner. When you choose to connect an account to your TotallyMoney account, we collect your open banking data from Bud.

5.

How we use your data

5.1.

Personalisation

All of our services are personalised to you. This means that we’ll analyse and profile your personal data to tailor the services we provide to you. This includes using the information that you have given us directly or that we have collected, such as account data, service-specific data or technical and behavioural data, and also information that we have obtained through third parties, such as your credit report data, credit score data, open banking data (where you have chosen to connect your account to our open banking service), eligibility data, energy results and product application data.

We’ll use your personal data to personalise the information and offers that we show you in your account and that we send to you by email or push notification.

For example, we’ll use your personal data to tailor:

Your Borrowing Power (see section 5.2 for more details);

The eligibility checks we do for you (see section 5.3 for more details);

The information we show you about your free credit report and credit score (see section 5.4 for more details);

Where you have agreed to receive marketing from us, the marketing material we send you (see section 5.6.2 for more details);

Our energy comparison and switching service (see section section 5.13 for more details).

TotallyMoney and its partners will soft search you while your account is live, to provide you with updates and personalised information and offers. For example, TotallyMoney and its partners will soft search your credit file with TransUnion and other credit reference agencies:

to calculate and update your Borrowing Power;

to create and update your free credit report, if you have one;

to provide you with quotes or match you with offers for which you are likely to be eligible; and

to analyse your financial situation, so that we can find other products and services you may be interested in.

See section section 5.5 for more details about soft searches.

5.2.

Borrowing Power

When you sign up for a TotallyMoney account, we’ll use your eligibility data to calculate your Borrowing Power. Your Borrowing Power is a score out of ten, which gives you an idea of the credit you may be able to access. We'll recalculate your Borrowing Power at least once a month for as long as you have a live TotallyMoney account. We reserve the right to suspend these regular recalculations if your account is inactive for 12 months or more.

Some of the soft searches that we do to calculate your Borrowing Power will leave a ‘footprint’ on your credit file. For more information about soft searches and footprints, see section 5.5.

5.3.

Eligibility checking

Our eligibility checking service works to find you offers. We then sort your offers based on their features and what's best for your credit profile. Although we may be paid commission, this never influences how your offers are ranked.

To do this, we use automated technology that assesses your personal data to create a profile of you (including your credit eligibility). We then use this information to search for and find suitable products for your credit profile.

Your eligibility results are based on our unique “Match Factor” algorithm, which considers factors such as:

your credit profile;

your eligibility score;

the features of the products; and

lender reliability.

Clicking out on email or push notification offers will prompt Experian and some of the partners that we work directly with to soft search your credit file. Some of these soft searches will leave ‘footprints’ on your credit file. TotallyMoney and its partners will also soft search your credit file while your account is live to personalise your offers and to find you other products and services you may be interested in. For more information about soft searches and footprints, see section 5.5.

We may use your credit score data and or credit report data to help us decide which lenders or credit brokers to share your personal data with. For some lenders we will pre-check whether you meet the lender or credit broker’s requirements, before we send your personal data to them. For more information about how we share your personal data with lenders and credit brokers, see section 7.

We’ll use your eligibility data to tailor the other services we provide to you. For example, we will use your eligibility data to tailor the marketing we send you, where you’ve agreed to receive marketing from us. For more information about how we use eligibility data to tailor marketing see section 5.6.2.

5.4.

Your credit score and free credit report

When you sign up for a TotallyMoney account, we may use your account data to check whether TransUnion is able to provide you with a free credit report and credit score. If we are going to do this check, we will make it clear to you in the sign up terms that are shown to you before you create your account.

You will need to successfully pass an authentication process before we can show you your credit report and credit score. If you pass, TransUnion will give us your credit report data and credit score data and we will display them in your account.

We may also ask for your updated credit report data and credit score data each month from TransUnion whilst your account is live. Each time you login we’ll update your credit score and only update your credit report, if our data suggests there’s been a change with TransUnion, or if it’s been more than a week since your last report update. We reserve the right to suspend these regular searches if your account is inactive for 12 months or more.

We may also ask for your updated credit report data and credit score data each month from TransUnion whilst your account is live, so that we can provide you with an updated credit report and credit score. Your credit score is updated once a day by TransUnion and this usually takes place overnight. Please note that lenders and other organisations that share information with TransUnion may take up to six weeks to report to TransUnion. So while the credit report data we show you is an up to date reflection of your credit file, your credit file may not capture more recent transactions or events.

We’ll use your credit report data and credit score data:

to provide you with your free credit report and credit score; and

to make our service better and more personalised to you, as explained in this privacy notice.

For a summary of the different ways in which we use your credit report data and credit score data see section 6. Some of the credit report and credit score soft searches that we do will leave ‘footprints’ on your credit file. For more information about soft searches and footprints, see section section 5.5.

5.5.

Soft searches and ‘footprints’ on your credit report

Some of our services involve soft searching your credit file. A soft search is like a quick peek at your credit file. Soft searches will not harm your credit rating or affect the way lenders see you.

You may see these soft searches as ‘footprints’ on your credit report in either our name or the name of one of the lenders, brokers, partners or credit reference agencies that we work with. Soft searches on your credit file will be given different markings, depending on their purpose, such as:

Affordability

Anti-Money Laundering

Consumer Credit File Request

Identity Check

Quotation/Preliminary Search

You may see multiple footprints on your credit file because soft searches may be carried out:

when you first sign up for our services;

when you go to the offers section of your account;

when you check or refresh your offers (e.g. when you click out on an email from us to ‘view offers’ or ‘find loans’) and;

in the background at least once a month to refresh your Borrowing Power, credit report and credit score (we reserve the right to suspend these regular searches if your account has been inactive for a period of time).

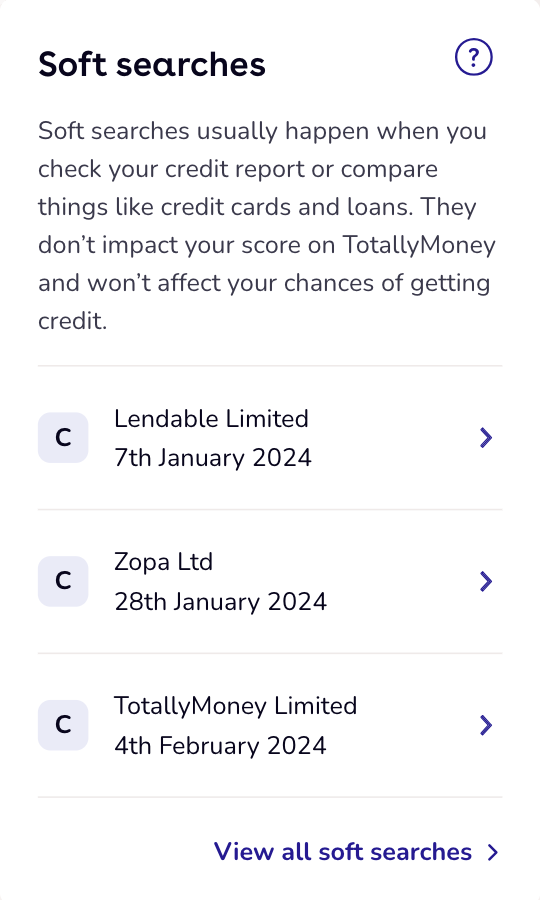

Here is an example of what footprints generated by our service might look like on your TotallyMoney free credit report:

Soft searches are not the same as hard searches. Hard searches (also known as “full credit checks”) are recorded when you apply for credit and they are visible to other lenders. TotallyMoney does not initiate hard searches on your credit file because TotallyMoney is not a lender, though you can use our service to check whether you have any hard searches on your TransUnion credit report.

If we run a trial with a potential supplier and partner and we need to use real rather than dummy or anonymous data for the test to be effective you may see a footprint relating to that trial on your credit file. See section 7.8 below for more details.

5.6.

Keeping in touch

5.6.1. Service messages

We’ll send you a welcome email when you sign up.

We’ll send you emails to tell you the results of your regular Borrowing Power search.See section 5.2 for more information about Borrowing Power.

If you have a free credit report with us, we’ll send you emails as a reminder that we’ve retrieved your credit report and credit score data from TransUnion.

We may also send you ad hoc service emails from time to time (for example, to contact you about forgotten passwords or to notify you about changes to our services).

If push notifications are enabled on your device, we may send you service messages by push notification.

Calculating your Borrowing Power and retrieving your credit report and credit score from TransUnion are core elements of our account service. We want to make sure that you remember that we are getting this data about you on a regular basis, even if you don’t need to log into your account very often. Similarly, other service messages will contain important information about your account or our services.

Please be aware that you can’t unsubscribe from service messages. If you do not wish to receive service messages, you will need to close your TotallyMoney account, which you can do by logging into your account and going to “My Details”.

We’ll keep refreshing your Borrowing Power, credit report and credit score (and sending you service messages about them) until you close your TotallyMoney account or we terminate or suspend your account (e.g. for misuse). We reserve the right to suspend these regular searches if your account is inactive for 12 months or more.

5.6.2. Marketing

When you sign up for a TotallyMoney account, you can choose not to receive marketing messages. You can also unsubscribe from receiving marketing communications at any time by:

updating your preferences from within your TotallyMoney account; or

emailing us at [email protected]; or

clicking the unsubscribe link in any marketing email from us; or

(for push notifications) updating your push notification preferences or settings.

If you have not opted out of marketing (or if you have otherwise consented to receiving marketing from us, for example when you apply for a Fluid card) we’ll use your personal data to send you tailored offers or information about our products and services that may be of interest to you.For example, we will use your personal data to predict when you may be interested in a new product because a product you currently have is coming to an end.

We may occasionally have arrangements in place with third parties that have a direct relationship with you and they may send information to you about us and our services where they are legally permitted to do so.

5.7.

Correspondence, surveys, competitions and prize draws

If you contact us, we’ll keep a record of that correspondence.

From time to time, we may use your personal data to contact you to ask you if you would like to take part in a survey, competition or prize draw. We’ll use any personal data you submit for a survey, competition or prize draw in accordance with this privacy notice and any additional terms and conditions associated with the survey, competition or prize draw.

5.8.

Website, app and message analytics

We use technical and behavioural data:

for system administration;

to measure and analyse traffic to our website or app;

to enable us to analyse behaviour and trends on the website and app; and

to personalise marketing (for example, if you have not opened marketing emails in a while, we may start sending you less).

5.9.

To meet legal or regulatory requirements

We and our third-party service providers are required to comply with certain legal and regulatory requirements including:

complying with our regulatory obligations to the Financial Conduct Authority and the Information Commissioner; and

addressing enquiries or complaints from you or from a regulator.

We may process your personal data to comply with those requirements. For example, the Financial Conduct Authority requires us to provide extra support to consumers that are vulnerable. To help us do this, we may add a ‘vulnerable consumer’ flag to your customer service record, if we consider that you meet the Financial Conduct Authority’s criteria for vulnerability.

Occasionally, we may be asked to provide certain information to regulators or law enforcement agencies. We’ll comply with these requests where legally required or permitted.

5.10.

Fraud prevention

TotallyMoney and the third parties that we work with (e.g. credit reference agencies, brokers and lenders) will process and share your data for the purposes of fraud prevention.

5.11.

Research and development and business insight

We’ll use your personal data to help us understand our customers and the market better and to improve our products and services. For example, we may analyse our customers’ account data, credit score data, credit report data, product application data and technical and behavioural data to spot trends or identify new product features that would be helpful to our customers.

We may also combine Offer data with certain service-specific data (such as the details of your enquiry (the amount, term and purpose of the loan you have requested)), eligibility data and behavioural data, and share our analysis of that with lenders so that lenders can understand how their offer compares with other offers generally. We may also share some of your data with lenders to help them develop their products and offerings for the benefit of our customers. We share the following types of data for this purpose:

• Offer data;

• some service specific data, such as the amount, term and purpose of the loan you have requested;

• eligibility data; and

• behavioural data.

Lenders use this data to understand how their offer compares with offers made by others. When we share your data for this purpose, we ensure that lenders are only permitted to use the data for research and development purposes. They are not permitted to use this data to make decisions about you.

5.12.

User panels and other customer research

From time to time, we may ask if you would like to join our customer panel or take part in other customer research. By agreeing to join the Customer Panel, you give us permission to use your personal information to check your eligibility for panel activities. We will send you invitations and other panel correspondence by email. We’ll use any personal data you submit or give us access to in accordance with this Privacy Notice and any additional privacy notices associated with our customer panel or customer research.

For more information on how our customer panel works, please see our Customer Panel Terms & Conditions.

5.13.

Energy comparison and switching

We’ll use your address to find out how much you might be able to save by using our energy comparison and switching service. We’ll tell you about this potential saving in your TotallyMoney account or, if you have agreed to receive marketing from us, by email or push notification.

If you use our energy comparison and switching service, we’ll pass some of your account data and your energy profile data to our energy comparison and switching service provider, Decision Tech, so that they can:

help us to help you complete your energy profile; and

tell us which energy tariffs are available to you (i.e. your energy results).

If you chose to switch energy supplier through us, we’ll pass some of your account data and your energy profile data to Decision Tech, so that they can help you with your switching application. We’ll show you the status of your energy switch in the energy section of your TotallyMoney account.

If you have any questions about your switch, we’ll use your account data and energy profile data to answer your questions, where we can. If we aren’t able to answer your questions, we may pass your complaint to the Moneysupermarket customer services team (Decision Tech is part of the Moneysupermarket group and their customer services team deals with questions on behalf of Decision Tech). Alternatively, we may ask you to contact the energy supplier that you are switching to directly.

If your application to switch is rejected by the energy supplier you have chosen, Decision Tech may use your email address and your energy profile data to send you a TotallyMoney branded email explaining the reason why you have been rejected and what to do next.

If you have agreed to receive marketing from us, we may send you marketing about energy comparison and switching. We may use your personal data to tailor that marketing. For example, we may send you a reminder when your current energy deal is coming to an end.

5.14.

Car insurance comparison service

We partner with Seopa Ltd (“Seopa”), trading as Quotezone, to provide you with a car insurance comparison service.

We’ll use the information you give us in our insurance estimator (e.g. car registration number, number of years of no claims) to get an insurance estimate through Seopa. We’ll tell you about this estimate in your TotallyMoney account.

If you choose to use the car insurance comparison service to get full insurance quotes, we’ll pass some of your account data to Seopa, so that they can prepopulate the quote form with the information that we already know about you. If you complete the quote form, Seopa will pass your data to its panel of insurers, to generate quotes. Seopa will show you your quotes and we will send you a copy for you to keep. If you choose to apply for a particular insurance product, Seopa will pass your data to the insurer, to help them to help you complete your application.

If you have any questions about the car insurance comparison service, we’ll use your account data and service-specific data to answer your questions, where we can. If we aren’t able to answer your questions, we may pass your question to Seopa, so that they can answer it. Alternatively, we may ask you to contact the insurance provider directly.

If you have agreed to receive marketing from us, we may send you marketing about the car insurance comparison service. We may use your personal data to tailor that marketing. For example, we may send you a reminder when your renewal date is approaching.

If you request quotes from Seopa’s panel of insurers, those insurers may run a ‘soft’ search on you, in order to generate quotes. A soft search is like a quick peek at your credit file. Soft searches will not harm your credit rating or affect the way lenders see you. For more information on soft searches, see section 5.5.

If you choose to take out insurance through Seopa, the insurer you are applying to will provide you with the terms and conditions for your new insurance policy. The insurer may also carry out their own security and credit checks. Any full credit check carried out by an insurer (also known as a ‘hard’ search) will be visible on your credit file to all lenders in the future. The basis on which the insurer uses your personal data should be set out in their privacy notice.

For more information about how Seopa’s will use your data, please read their Privacy Notice.

5.15.

Open banking

If you choose to connect an account to your TotallyMoney account via our open banking partner Bud, we will use your open banking data to provide you with TotallyMoney services that are powered by open banking data.

For example, we will use your open banking data to:

see if you can reveal pre-approved offers for loans;

help you keep on top of your finances (e.g. see your balance after bills); and

give you access to new TotallyMoney open banking services that we develop in the future (but we will only use your open banking data for new services if your bank account is connected when the new service launches).

check your eligibility on behalf of lenders to offer additional products or services to our customers.

Where we use open banking data to find you pre-approved offers for loans, your open banking data is used to check your financial position beyond your credit report. This helps us, and lenders, understand what products you can afford.

We will use your open banking data to personalise:

the content you see on the TotallyMoney website and app; and

the marketing we send you (where you have agreed to receive marketing from us)

For more information about how we use your personal data to personalise your TotallyMoney account, please see section 5.1 of this privacy notice Personalisation. For more information about how we use your data for marketing, please see section 5.6.2. of this privacy notice Marketing.

We will share your open banking data with our partners (such as lenders) so that they can carry out research to help us improve our services. For example, they will use open banking data to check whether access to open banking data will enable them to offer additional products or services to our customers. We will also anonymise your open banking data and use the anonymised data to help us improve our products and services.

We may refresh your open banking data up to four times a day while your account is connected. Your bank account will remain connected for 90 days. You can then choose to renew your connection or let it expire. You can disconnect your account at any time through your TotallyMoney account or your bank. Connecting your account will not affect your credit score or credit report in any way.

If you choose to connect a joint account to your TotallyMoney account, you should show the joint account holder this Privacy Notice first. By connecting the joint account you are acknowledging that you have done this.

Your open banking data may contain ‘special category’ data. Special category data is personal data that needs more protection because it is sensitive. For example, if you pay a trade union membership fees that could show that you are a member of a trade union, which is special category data. We do not deliberately collect this special category data and it will not affect or influence the services we provide to you. We keep all of your personal data including any special category data secure. By connecting your bank account you are consenting to this incidental processing of any special category personal data contained in your open banking data.

6.

Our legal bases for processing your personal data

We’ve set out below, the legal bases on which we process your personal data. We’ve also identified what our legitimate interests are, where appropriate.

Scroll

|

Purpose/Activity |

Type of data |

Lawful basis for processing including basis of legitimate interest |

|

To provide you with Borrowing Power |

• Account data • Eligibility data |

Performance of a contract with you |

|

To provide you with your credit score and free credit report and information based on your credit score and free credit report |

• Account data • Credit report data • Credit score data |

Legitimate interest (When you sign up for a TotallyMoney account and we use your account data to check whether TransUnion is able to provide you with a free credit report and credit score) Performance of a contract with you (when we retrieve your credit report data and credit score data) |

|

To provide you with our eligibility checking service (credit products) |

• Account data • Eligibility data • Credit report data • Credit score data • Product application data • Technical and behavioural data • Open banking data |

Performance of a contract with you |

|

To provide you with services powered by open banking data (e.g. showing you your balance after bills) |

• Open banking data |

Performance of a contract with you |

|

To send you service messages |

• Account data • Credit report data • Credit score data • Product application data • Energy profile data • Energy results • Service-specific data • Open banking data |

Performance of a contract with you |

|

To send you marketing messages or to include or exclude you from targeted advertising |

• Account data • Eligibility data • Credit report data • Credit score data • Marketing data • Technical and behavioural data • Energy profile data • Energy results • Service-specific data • Open banking data |

Necessary for our legitimate interests (to promote our products and services) Consent (e.g. where you give opt-in consent to a third party such as our sister company, TM Connect Limited, to receive email marketing from us or when you opt in to marketing using the preference centre) |

|

Correspondence with you (customer queries) |

• Account data • Product application data • Marketing data • Technical and behavioural data • Energy profile data • Service-specific data • Any additional personal data that you provide as part of your correspondence • Open banking data |

Necessary for our legitimate interests (to ensure customer satisfaction and to answer queries about the service, to monitor trends in queries to improve the services) |

|

To enable you to partake in a prize draw, competition or complete a survey |

• Account data • Eligibility data • Credit report data • Credit score data • Marketing data • Technical and behavioural data • Energy profile data • Service-specific data |

Performance of a contract with you (to administer the prize draw, competition or survey) Necessary for our legitimate interests (to study how customers use our products/services, to develop them and grow our business) |

|

To meet legal or regulatory requirements |

• Account data • Credit report data • Credit score data • Eligibility data • Energy profile data • Energy results • Marketing data • Service-specific data • Product application data • Technical and behavioural data • Open banking data |

Compliance with a legal or regulatory requirement to which we are subject |

|

To assist the wider industry with fraud prevention |

• Account data • Product application data • Technical and behavioural data |

Necessary for our legitimate interests (as a company working in this industry) |

|

To carry out research and development and business insight |

• Account data • Eligibility data • Credit report data • Credit score data • Marketing data • Product application data • Offer data • Technical and behavioural data • Energy profile data • Energy results • Service-specific data • Open banking data (on an anonymised basis) |

Necessary for our legitimate interests (to help us understand our customers, to improve our products and services and to inform our marketing strategy) and, where applicable, lenders' legitimate interests (to allow them to develop their products and offerings for the benefit of our customers). |

|

To invite you to take part in our customer panel or other customer research |

• Account data • Eligibility data • Credit report data • Credit score data • Marketing data • Product application data • Technical and behavioural data • Energy profile data • Energy results • Service-specific data |

Necessary for our legitimate interests (to help us understand our customers, to improve our products and services and to inform our marketing strategy) |

|

To calculate any commission payments due to us from partners as a result of your application |

• Product application data |

Necessary for our legitimate interests (to calculate commission due to us) |

|

Energy comparison and switching |

• Account data • Energy profile data • Energy results • Product application data |

Performance of a contract with you |

|

Car insurance comparison |

• Account data • Service-specific data • Product application data |

Performance of a contract with you |

|

To provide extra support to vulnerable consumers |

• Vulnerable consumer flag • Information that you volunteer to us (this could include information about your physical or mental health) |

Compliance with a legal or regulatory requirement to which we are subject Where health data is processed, we need to have an additional condition to permit us to process this data. Where we process health data for vulnerable consumer purposes, we do so because it is necessary for reasons of substantial public interest (safe-guarding the economic well-being of certain individuals) |

|

To share information with our partners so they can carry out research to help us improve the TotallyMoney service |

• Open banking data |

Necessary for our legitimate interests (to improve our services) |

7.

How we share your personal data with others

7.1.

Sharing your personal data with credit reference agencies (Experian, Equifax and TransUnion)

A credit reference agency is a company that collects personal information from various sources and provides that personal information for a variety of uses (including to prospective lenders for the purposes of making credit decisions).

We share your personal data with Experian Ltd (“Experian”), who conduct pre-screening searches and eligibility checking on our behalf. Experian uses your personal data:

so that they can check your eligibility for the credit products listed on our site;

for fraud prevention purposes; and

for research and development purposes, as further described in section 5.11.

Please read Experian’s terms by clicking here.

If you use our open banking services, we may share your open banking data with Equifax Limited and its group companies (“Equifax”) to help reveal pre-approved loan offers in your TotallyMoney account. This is because some loan lenders that TotallyMoney works with use Equifax to help them to process, understand and/or make decisions based on your open banking data. Where we share your personal data with Equifax, Equifax will also keep an anonymous copy of your data, to help them improve their services. For example, Equifax may use the anonymised data for statistical analysis and the optimisation of its services. Please read Equifax's terms here

We share your personal data with TransUnion International UK Limited (“TransUnion”) to provide the credit report and credit score services. When we check whether TransUnion is able to provide you with a credit report and when we retrieve your credit report data and credit score data from TransUnion, we are making a subject access request under Article 15 of the UK GDPR to TransUnion, on your behalf.

The way that TransUnion uses your data is set out in the TransUnion privacy notice, which can be found here. TransUnion’s company number is 03961870 and their registered office is One Park Lane, Leeds LS3 1EP. TransUnion International UK Limited is authorised and regulated by the Financial Conduct Authority under registration number 737740. Authorisation can be checked on the FCA Register.

If you apply for a free credit report:

TransUnion will ask you for personal data to verify your identity and to authenticate you. TransUnion may ask you knowledge-based questions based on your credit history, that only you should know the answers to. If you use this method of authentication, we do not see the information you provide, even though it is provided to TransUnion through a TotallyMoney branded interface. We only see the outcome of the authentication process (e.g. authentication pass/failure).

The device that you use when you apply for your free credit report will be checked, for fraud prevention purposes. We share information about the device you are using with TransUnion. TransUnion and its service provider, iovation Inc., check whether your device has been identified with fraudulent transactions in the past, such as reported instances of identity theft, account takeovers, or malware attacks. This fraud prevention service uses cookies and similar technologies. If you set your browser or device to reject these cookies or similar technologies, you may not be able to get your free credit report through our website. For more information about how this service uses information from your device, see here.

If TransUnion can authenticate you for the credit report service, TransUnion will provide us with a unique ID that we use to request your credit report data and credit score data.

The credit reference agencies will use the information you provide when setting up your TotallyMoney account and while using our services for the purposes of operating as a credit reference agency. This will include using such data for statistical purposes, to assist with identity verification, prevention of fraud / money laundering, tracing and collection of debt, service delivery and process implementation.

7.2.

Sharing your personal data with lenders

We share your personal data with a range of lenders:

so that they can check your eligibility for their products, including whether you’re an existing customer (this helps us to limit the number of soft searches carried out on you);

to pre-populate any lender application form you chose to complete; and

for fraud prevention purposes.

We may use your credit score data and/or credit report data to help us decide which lenders to share your personal data with. For example, we may pre-check whether you meet the lender’s requirements, before we send your personal data to them.

We may also share limited details about you with lenders or their agents to verify any commission payments due to us as a result of your application. If you choose to connect an account to your TotallyMoney account via our open banking partner Bud, we will share your open banking data with lenders. Lenders will use your open banking data to:

check your eligibility for products

make sure that you can afford those products

prepopulate the product application form, should you choose to apply for the product

on an anonymised basis to improve their products and services

where they have a legal obligation to do so, for example for anti-money laundering and fraud prevention purposes

Some lenders will use Experian to process and/or categorise your open banking data. Where this is the case, Experian may also anonymise your open banking data and use it for their own purposes. See Section 7.1 of this privacy notice, ‘Sharing your personal data with credit reference agencies (Experian, Equifax and TransUnion)’ for more details.

If you apply for a lender’s product as a result of using our service, they will provide you with the terms and conditions for that product. They will also carry out their own identification and validation checks (including fraud prevention procedures), affordability and credit application checks in accordance with their own criteria. Any full credit check (also known as a ‘hard search’) carried out by a lender will be visible on your credit file to all lenders in the future. The basis on which a lender or other service provider uses your personal data should be set out in their privacy notice.

If you would like any more information about lenders that we currently work with, please email us –[email protected].

7.3.

Sharing your personal data with other credit brokers

We share your personal data with other credit brokers that we work with.

Some products may need specialist expertise (e.g. certain types of secured loans, mortgages and car finance). If you tell us that you are interested in those products, we’ll introduce you to a specialist credit broker. Look out for notices on our website and app that tell you when we are going to pass your information to another credit broker, as they may contact you to follow up on your enquiry. If you choose to work with another credit broker, you will then be bound by their terms and privacy policy.

The specialist credit brokers we currently work with are:

Scroll

|

Credit broker |

Products |

Link to credit broker’s own Privacy Notice |

|

Aspire Money Limited |

Loans | |

|

Monevo Limited trading as Monevo |

Loans | |

|

Believe Money |

Loans and secured loans | |

|

Norton Finance |

Secured loans | |

|

Ocean Finance |

Secured loans | |

|

Aro Finance Limited |

Secured loans | |

|

London & Country |

Mortgages | |

|

Evolution Funding Limited trading as My Car Credit NB Evolution acts on behalf of a number of specialist lenders, including Paragon Car Finance, Moneybarn and Evolution Loans Ltd. See their Privacy Notice for more details. |

Car finance | |

|

Zuto Limited trading as Zuto NB Zuto acts on behalf of a number of specialist lenders, including Autolend, Moneybarn, MoneyWay and Zuto loans. See their Privacy Notice for more details. |

Car finance | |

|

247 Money Group Limited and CarFinance 247 trading as Car Finance 247 |

Car finance | |

|

CarMoney Limited trading as CarMoney |

Car finance | |

|

Match Me Car Finance Ltd trading as Match Me Car Finance |

Car finance |

We share your personal data with other credit brokers:

so that they can check your eligibility for credit;

to pre-populate any application form you chose to complete; and

for fraud prevention purposes.

We may use your credit score data and/or credit report data to help us decide which credit brokers to share your personal data with. For example, we may pre-check whether you meet the credit broker’s requirements, before we send your personal data to them.

We may also share limited details about you with credit brokers or their agents to verify any commission payments due to us as a result of your application.

If you apply for a product as a result of using another credit broker’s services, the credit broker or the lender will provide you with the terms and conditions for that product. They will also carry out their own identification and validation checks (including fraud prevention procedures), affordability and credit application checks in accordance with their own criteria. Any full credit check (also known as a ‘hard search’) carried out by a credit broker or lender will be visible on your credit file to all lenders in the future. The basis on which another credit broker uses your personal data should be set out in their privacy notice.

7.4.

Sharing your data for energy comparison and switching

Our energy comparison and switching service is powered by Decision Technologies Limited, a company registered in England & Wales under company number 05341159 with its registered address at First Floor, High Holborn House 52-54 High Holborn London WC1V 6RL (“Decision Tech”).

We share your personal data with Decision Tech so that they can help us help you switch. For example, we share your personal data with Decision Tech:

to help you complete your energy profile (for example, we’ll share your address with Decision Tech so that they can look up your meter numbers);

to find out what energy tariffs are available to you; and

to pre-populate your switching application form.

Decision Tech will share limited details about you with their suppliers so that we can help you switch. For example, Decision Tech share your address with GB Group plc, who provide Decision Tech’s address look-up service.

Decision Tech is part of the MoneySupermarket group of companies. Decision Tech will share limited details about you with MoneySupermarket so that we can help you switch. For example, if your switch is rejected, MoneySupermarket may email you on our behalf to tell you why and what to do next.

For more information about how Decision Tech will use your personal data, please read theirPrivacy Notice.

If you choose to switch energy suppliers, the energy supplier you are switching to will provide you with the terms and conditions for your new energy tariff. The energy supplier will also carry out their own security and credit checks. Any full credit check carried out by an energy supplier will be visible on your credit file to all lenders in the future. The basis on which the energy supplier you are switching to uses your personal data should be set out in their privacy notice.

7.5.

Sharing your data for car insurance comparison

We partner with Seopa Ltd (“Seopa”), trading as Quotezone, to provide you with a car insurance comparison service.

We share your data with Seopa so that they can give us an insurance estimate to show you in our insurance estimator. If you choose to use the car insurance comparison service to get full insurance quotes, we’ll pass some of your account data to Seopa, so that they can prepopulate the quote form with the information that we already know about you. If you complete the quote form, Seopa will pass your data to its panel of insurers, to generate quotes. If you choose to apply for a particular insurance product, Seopa will pass your data to the insurer, to help them to help you complete your application. If you have any questions about the car insurance comparison service that we aren’t able to answer, we may pass your question to Seopa, so that they can answer it.

For more information about how Seopa’s will use your data, please read their Privacy Notice.

7.6.

Sharing your personal data with marketing service providers and third-party advertising companies

We share a limited amount of your personal data with companies that help us with marketing and advertising, namely:

your marketing preference data (i.e. whether or not you have agreed to receive marketing from us);

your technical and behavioural data (e.g. cookie and pixel data); and/or

your email address (in a protected format).

The marketing and advertising companies with whom we share your personal data include service providers who provide platforms and systems that we use to help us serve marketing and advertising (i.e. Facebook, TikTok, Taboola and Google)

Some of this information is gathered through cookies and other similar technologies on our website and app. For more information about how we use cookies please see our Cookie Policy.

In some cases, these third parties will also use the data that they collect for their own purposes, for example they may aggregate your data with other data they hold and use this to inform advertising related services provided to other clients.

7.6.1. Sharing your personal data with Facebook and TikTok (in more detail)

We share customer email addresses (in a protected format) and cookie data about customers and recent visitors to our website with Facebook and TikTok, so that they can help us show our adverts to the right people. For example, we share this data with Facebook and TikTok so that we can exclude existing customers and people that have visited our website recently from advertising campaigns that are aimed at finding new customers.

We may share your marketing data, information about your visits to our website (i.e. cookie data) and/or your email address (in a protected format) with Facebook and TikTok:

to prevent you from receiving TotallyMoney targeted adverts on Facebook and TikTok if you have opted out of TotallyMoney marketing;

to exclude you from advertising campaigns aimed at finding new users, if you already have a TotallyMoney account;

to show TotallyMoney adverts to users who have visited the TotallyMoney website but haven’t yet created a TotallyMoney account;

to show TotallyMoney adverts to existing TotallyMoney customers to encourage them to use the service (for example, when we make improvements to the service, we may advertise these improvements to existing customers);

to create an audience for our advertisements of other Facebook or TikTok users who have similar characteristics to you based on the information Facebook or TikTok holds about you (also known as a Lookalike Audience); or

to include you in a “custom audience” that will receive TotallyMoney advertising content on Facebook or TikTok(a custom audience is essentially a list of people who we think are most likely to be interested in a particular advertisement).

7.6.2. Sharing your personal data with Taboola (in more detail)

We use Taboola to place advertising on our behalf. Taboola will place TotallyMoney adverts on third party publisher sites that host advertising. We share cookie data with Taboola to allow Taboola to show TotallyMoney adverts to users who have visited the TotallyMoney website but haven’t created a TotallyMoney account. We also share cookie data with Taboola to allow them to exclude existing TotallyMoney customers from TotallyMoney advertising campaigns that are aimed at finding new customers.

7.6.3. Sharing your personal data with Google (in more detail)

We use the Google platform to show relevant ads to potential customers and existing customers. This allows us to make sure that the relevant information goes to a specific group of people and you are always up to date with our newest features and products. For instance, we generally inform existing customers about new product features and exclude them from ad campaigns that aim to attract new customers. In order to do so, we share customer email addresses with Google. Google will keep your data confidential and secure using the same industry-leading standards that they use to protect their own user data and will not share it with other advertisers.

7.7.

Sharing your personal data with group companies

We work with and are an appointed representative of TM Connect Limited to provide our services to you. This requires us to share your personal data with TM Connect Limited, so that TM Connect Limited can meet its regulatory obligations as the regulated principal.

We may also disclose your personal data to any member of the TotallyMoney group, which means our subsidiaries, as well as our ultimate holding company and its subsidiaries. For example, way may share your personal data with group companies:

if another group company is helping us deliver the services;

where we have regulatory reporting requirements that mean we need to share personal data; or

in the event of a corporate restructure.

7.8.

Sharing your personal data with other third parties

We may share your personal data with:

the Financial Conduct Authority, the Information Commissioner’s Office or any other legal, regulatory or governmental body that we are required to disclose information to;

our suppliers of technical and support services, insurers, logistic providers, and cloud service providers;

the analytics and search engine providers that assist us in the improvement and optimisation of our website.

We may share your personal data with potential suppliers and partners if want to trial those suppliers and partners to see if they can help us improve our services. For example, we may share your personal data with potential suppliers and partners to test the efficacy of their systems. We’ll only do this where we need to use real rather than dummy or anonymous data for the test to be effective. Some of these trials will involve soft searching your file and may leave footprints on your credit file. For more information on soft searches and footprints, see section 5.5 above.

We may consider corporate transactions such as a merger, acquisition, reorganisation or asset sale. We may share information with third parties in relation to that transaction. If we are acquired in whole or part, customer personal data may be one of the assets transferred.

We may disclose or share your personal data with third parties (e.g. professional advisors or public bodies) if it is necessary to:

enforce or apply our terms of use and other agreements;

protect the rights, property or safety of our staff, customers or other people.

This includes exchanging information with other companies and organisations for the purposes of identity verification and validation, fraud protection and credit risk reduction.

7.9.

Transferring your personal data internationally

The data that we collect from you may be transferred to, and stored at, a destination outside of the UK in connection with the above purposes. For example:

we use an American email service provider to send our service and marketing emails;

we use an American software provider to supply the software platform we use to manage customer queries;

the credit reference agencies and partners that we work with may also transfer your personal data outside of the UK (for more details, please read their privacy notices).

If we transfer any of your personal data outside of the UK, we’ll take steps necessary to ensure that your data is treated securely and in accordance with this privacy notice and all relevant statutory requirements. This includes using recognised transfer mechanisms that incorporate appropriate safeguards. For example, we use approved standard contractual arrangements to transfer personal data, where appropriate.

Further details on the steps we take to protect your personal data in these cases is available from us on request by contacting us by email at [email protected] at any time.

8.

How we store your personal data

8.1.

What we do to keep your personal data safe

TotallyMoney takes privacy and security seriously. The internet is not a secure medium, but we've put in place appropriate physical, technical and administrative measures to safeguard and secure your information. We are continually investing in security technologies to prevent cyber-attacks and breaches. Our security policies are in place to safeguard your privacy from unauthorised access or improper use and are in line with best practices. We'll continue to enhance our security as and when new technology becomes available.

8.2.

What you can do to keep your personal data safe

You’re responsible for keeping your TotallyMoney account password confidential. We ask you not to share the password as anyone who knows your password may access your account. We will never ask you for your password. When creating a password, use at least 8 characters. A combination of letters and numbers is best. We recommend that you do not use dictionary words, your name, email address, or other personal data that can be easily obtained. We also recommend that you frequently change your password. You can change your password in your TotallyMoney account.

8.3.

How long we keep your personal data for

We keep your personal data for no longer than necessary for the purposes for which the personal data is processed. We may retain personal data where we need to for:

the purposes of complying with our legal and regulatory responsibilities;

responding to legal and regulatory enquiries; and

our own required record keeping.

For example, we’ll keep your sign-up data, eligibility data, credit report data, credit score data, marketing data and technical and behavioural data for as long as your account is live. If you close your account, we’ll remove this data from our live systems. We’ll archive a limited amount of personal data (e.g. your address, postcode, date of birth and email address) so that we can:

Answer any queries/complaints you may have;

Respond to queries or investigations from the Financial Conduct Authority or Financial Ombudsman Service;

Respond to legal claims.

We’ll keep the archived data for no longer than six years following your account closure.

9.

How we use artificial intelligence at TotallyMoney

In this Privacy Notice, when we refer to ‘artificial intelligence’, we mean using computer systems to perform tasks that would normally require human intelligence. We use artificial intelligence to help us provide you with some of our services. We also use artificial intelligence to help us understand our customers and the market better and to improve our products and services.

For example, we use an algorithm to calculate your Borrowing Power. The algorithm takes into account the products that you are eligible for, as well as what those products are, to create your Borrowing Power. Your Borrowing Power is a score out of ten, which gives you an idea of the credit you may be able to access. For more information on Borrowing Power, see section 5.2.

We also use an algorithm to rank the credit products that we show you. We call this algorithm ‘Match Factor’. For more information about Match Factor, see section 5.3.

Finally, we use artificial intelligence (e.g. algorithms and machine learning) for research and development and for business insight. For example, we may use artificial intelligence to analyse how our customers are using our website, to help us understand which products and services they find most useful. For more information about how we use your data for research and development and business insight, see section 5.11.

We regularly review our use of artificial intelligence to make sure that the decisions we make using artificial intelligence are fair and accurate. Wherever possible, we use anonymised data. Where we use personal data we make sure that the data is secure and that we comply with data protection law.

10.

Your legal rights

You have various rights in respect of our use of your personal data, including:

10.1.

Your right to be informed

You have the right to be informed about the collection and use of your personal data. This is a key transparency requirement under the UK General Data Protection Regulation (“UK GDPR”). We must provide you with information including:

our purposes for processing your personal data;

our retention periods for that personal data; and

details of who it will be shared with.

This information is set out in the transparency notices on our website and app and in this privacy notice.

10.2.

Your right to access

You have the right to access the personal data that we hold that relates to you. This is commonly referred to as a subject access request or “SAR”. You can make a SAR and view the personal data TotallyMoney holds on you. Please note that the personal data won’t include:

Information relating to another person (e.g. a fraudster) who has opened an account in your name, where we’ve good reason to believe that the personal data doesn’t relate to you (e.g. that person’s IP address);

your credit report and credit score (you can view your credit report and credit score in your TotallyMoney account).

10.3.

Your right to rectification

This right lets you correct or change any personal data we hold on you that’s wrong or out of date. You can change any of your account information, except your date of birth, by visiting ‘Edit My Details’ in your account. If you would like to change your date of birth, or you’re having problems editing your details, please contact us at [email protected]. Please note that we can’t correct information on your credit report. You can challenge incorrect information on your credit report using the “raise a dispute” function in your account. This will allow you to raise the dispute directly with TransUnion, who provide the credit report data.

10.4.

Your right to erasure

Your right to erasure (or ‘the right to be forgotten’) is a right to ask for your personal data to be erased. We can do this — no problem — but it means we’ll close your account. Without certain personal data we can’t deliver our services. And if we can’t deliver our services, we become pretty useless to you. Once you’ve requested your right to erasure we’ll comply, but we can’t immediately delete everything. Some information associated to your TotallyMoney account must be kept for a limited period, for legal and regulatory purposes (see section 8 for more details).

10.5.

Your right to restrict processing

You have the right to request that we restrict or suppress the processing of your personal data. This is not an absolute right and only applies in certain circumstances, including where:

you contest the accuracy of your personal data and we are verifying the accuracy of the data;

the data has been unlawfully processed and you oppose erasure and request restriction instead;

we no longer need the personal data, but you need us to keep it in order to establish, exercise or defend a legal claim; or

you have objected to us processing your data under Article 21(1) of the UK GDPR (e.g. an objection to processing on the grounds of legitimate interest), and we are considering whether our legitimate grounds to process your data override your rights and interests.

10.6.

Your right to data portability

The right to portability lets customers transfer data easily from one system to another. It’s safe and secure and doesn’t impact the data’s credibility. You can request a copy of the data that you have provided to TotallyMoney in a re-usable format. This right relates to personal data you have provided to us where our legal basis for processing is performance of a contract or consent (e.g. sign-up data).

10.7.

Your right to object

You have the right to object to our processing of your personal data. This effectively allows you to ask us to stop processing your personal data. The right to object only applies in certain circumstances. Whether it applies depends on our purpose for processing and our lawful basis for processing.

You have the absolute right to object to the processing of your personal data for direct marketing purposes. If you exercise this right, we’ll stop using your personal data for this purpose.

You can also ask us to consider any valid objections which you have to our use of your personal data where we process your personal data based on our, or another person's, legitimate interest. This is not an absolute right, and we can continue processing your personal data if:

we can demonstrate compelling legitimate grounds for the processing, which override your interests, rights and freedoms; or

the processing is for the establishment, exercise or defence of legal claims.

10.8.

Your right to withdraw consent

If we rely on consent to use your personal data in a particular way, but you later change your mind, you may withdraw your consent by contacting us at help@totallymoney and we’ll stop doing so. Details of where we rely on consent can be found in the section 6 above.

10.9.

How to exercise your rights

To exercise the rights outlined above in respect of the personal data processed by us as a controller contact us or email us at [email protected]. We may need further information to verify your identity before we can respond to your request. We’ll consider all requests and provide our response within a reasonable period (and in any event any period required by applicable law). Certain personal data may be exempt from such requests in certain circumstances. If an exception applies, we’ll tell you this when we respond to your request.

10.10.

Your right to complain

If you have any complaints about our collection, use or storage of your personal data please contact us at help@totallymoney. We’ll investigate and attempt to resolve your complaint. You may also make a complaint to the UK Information Commissioner (www.ico.org.uk). Alternatively, you may seek a remedy through local courts if you believe your rights have been breached.

If your complaint relates to the data that TransUnion holds and we can’t resolve your complaint, we may refer it to TransUnion.

11.

How to contact us

If you have any questions about this privacy notice or our use of your personal data, please contact us or email us at help@totallymoney.

Details of changes to this privacy notice

| Version | Date | Details of Changes |

|---|---|---|

1.0 | 03/07/2017 | First published. |

1.1 | 18/07/2017 | New second sentence added to the first paragraph of section 7 to provide further clarification that third party arrangements may exist. |

1.2 | 15/08/2017 | References to Media Ingenuity Limited changed to TotallyMoney Limited to reflect name change of company number 06205695. |

1.3 | 17/08/2017 | Minor updates to Paragraphs 5, 6 and 7 including the addition of Experian’s terms and to clarify unsubscribe routes. |

1.4 | 01/05/2018 | Amended to reflect the closure of Intelligent Alerts Service to new customers. |

2.0 | 16/05/2018 | Updated to reflect requirements of the General Data Protection Regulation. |

2.1 | 25/05/2018 | Further amendments to reflect requirements of the General Data Protection Regulation. |

2.2 | 19/11/2018 | Updated to reflect the requirement for account creation in order to access most services, and other less significant changes. |

2.3 | 15/01/2019 | Amended to reflect the requirement to register for most services. |

2.4 | 23/04/2019 | Updated references to Callcredit to become references to TransUnion (Callcredit change of name). |

2.5 | 27/06/2019 | Updated to include more information about our services, soft searches and ‘footprints’ on your credit file. |

2.6 | 28/06/2019 | Added information to sections 5.4 (now section 5.5) and 7.5 (now section 7.7) to explain how we use data in new suppliers/partners trials. |

2.7 | 08/07/2019 | Updated to reflect change of address from Churchill House to Chapter House. |

2.8 | 02/08/2019 | Updated to reflect that TotallyMoney no longer provides credit card comparison service to Confused.com customers. |

2.9 | 27/09/2019 | Updated to reflect: (a) new affordability questions; and (b) fact that secured loan broker carries out direct eligibility checks |

3 | 26/12/2019 | Updated to reflect: (a) new uses of credit score data and credit report data to personalise the service; (b) new energy comparison and switching service; (c) addition of Evolution car finance service; (d) updates to information about how we use Facebook for targeted advertising; (e) addition of Taboola to section on targeted advertising; (f) updates to list of soft search footprints. |

3.1 | 28/01/2020 | Amended to reflect that TotallyMoney stopped providing eligibility checking services for customers of Credit Karma on 28 January 2020. |

3.2 | 01/06/2020 | Updated information on credit brokers that we work with in table in section 7.3. Updated list of footprints in section 5.5. Removed links to bespoke Credit Karma privacy notice and T&Cs (service discontinued 28 January 2020). Removed references to opt-in energy alerts (not available). Added information about flagging of vulnerable consumers and legal basis for processing of those flags. |

3.3 | 10/08/2020 | Updated section 7.8. (transferring your personal data internationally) to remove references to Privacy Shield. |

3.4 | 04/12/2020 | Adding references to push notifications Removing references to Know Your Money and Credit Karma (historic services, now closed) Updating section on use of technical and behavioural data to include use of data to personalise marketing Adding references to new car insurance comparison service Updating list of brokers we work with. |

3.5 | 10/12/2020 | Updates to reflect new ‘live’ credit report service Updates to reflect changes to the way we calculate borrowing power Adding information about how TotallyMoney uses artificial intelligence and machine learning. |

3.6 | 04/03/2021 | Adding reference to TransUnion fraud checks to section 7.1. Updated section 5.6.1 regarding service messages. Updating section 5.12 and section 6 with references to our new customer panel. Updating sections 7.1, 7.9, 10.1 and 10.5 in light of Brexit (e.g. changing references to GDPR to UK GDPR). |

3.7 | 17/01/2022 | Updating sections 5.2 (Borrowing Power), 5.3 (Eligibility checking) and 5.5 (Soft searches and ‘footprints’ on your credit report) to reflect that a new soft search is no longer generated each time customer logs in (change to caching rules). |

3.8 | 15/11/2022 | Adding information about use of Google Audiences and TikTok. General updates to reflect updates to product and services. |

4.0 | 23/11/2022 | Updates to reflect launch of TotallyMoney open banking service (eligibility checking). |

4.1 | 30/11/2022 | Adding provisions relating to TotallyMoney debit card. |

4.2 | 15/05/2023 | General updates and adding information about new open banking services. |

4.3 | 27/10/2023 | Removing provisions relating to TotallyMoney debit card. |

4.4 | 27/10/2023 | Adding provisions relating to sharing non-anonymised personal data with potential lenders for research purposes. |

5.0 | 20/02/2024 | Updates to reflect potential sharing of Offer data with lenders and clause 5.5 on soft searches. |

5.1 | 20/04/2024 | Updated to reflect change of address from Chapter House to White Collar Factory. |

5.2 | 30/05/2024 | Updated to reflect credit report and open banking services. |

5.3 | 14/08/2024 | Updating list of brokers we work with. |