The Shared Ownership Scheme

In an attempt to help more people get onto the property ladder, the Government has instituted a series of Help to Buy schemes that can assist first-time buyers with purchasing a home. One of those is the Shared Ownership Scheme – and to help you get an idea of how that works, TotallyMoney have put together this straightforward guide.

What is the shared ownership scheme?

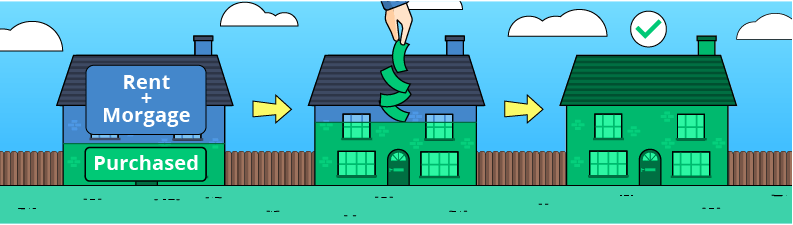

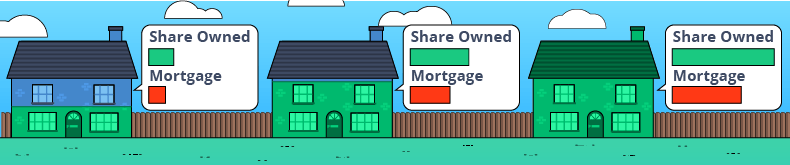

The buyer purchases a share between 25% and 75% of a property, either outright or through a mortgage on that share, from a housing association (a non-profit organisation set up to provide low-cost housing), and then pays rent on the remainder. By a process called “staircasing”, they are then able to increase their share up to 100% and own the lease of the property, meaning they no longer have any rent to pay.

How does it work?

By purchasing a 25% – 75% share of a property rather than the whole property, the buyer can pay less or secure a lower mortgage. They have to pay rent on the other share to the housing association from which the property is being bought, and over time they can “staircase” up to owning the full property.

For example, on a £200,000 home, a buyer might purchase a 25% share at £50,000 with a mortgage and a deposit, typically 5% rather than the usual 10%, on that amount. They would then pay off the mortgage to the bank, while paying annual rent of around 2.75% on the remaining £150,000, of £4,125.

Shared ownership homes can be found through the national website Sharetobuy.com

Why does it exist?

Shared ownership means that people who can’t afford more expensive properties or can’t secure higher mortgages can get onto the property ladder earlier, with greater flexibility in terms of how they achieve the property purchase.

What are the advantages and disadvantages?

Advantages

The primary advantage of the shared ownership scheme is that it makes property purchase more affordable. With buyers able to purchase as little as a 25% share in a property, and the deposit required only 5% of that (instead of being 5% on the whole property), the cost of making the property purchase is much lower.

For example, on a 25% share of a £200,000 property, the deposit would be only £2,500, as it’s paid on £50,000 instead of the full £10,000 deposit required for the £200,000 property.

Additionally, the rent on the remainder of the property is usually less than that charged on the open market, and is typically 2.75% of the value of the share of the property not owned, each year. This would be £4,125 a year on a 25% share of a £200,000 property.

Further costs might be deferred if they’re not reduced – if you own a share under 30%, for example, stamp duty land tax (if applicable) is generally deferred until the share reaches 30%, or paid in stages, preventing those with reduced finances from taking on too many costs at once.

Disadvantages

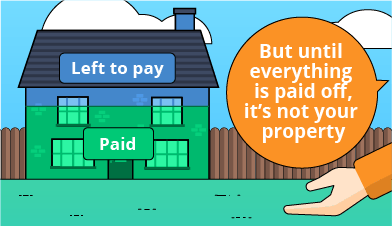

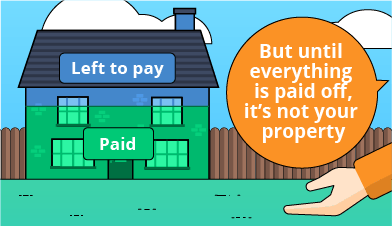

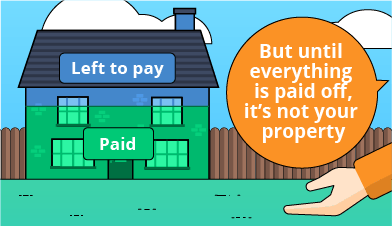

There are difficulties with the scheme, however. Until the buyer owns 100% of the house, the contract means that they do not actually officially own a share of a property. Instead, the contract is an assured tenancy for the term of the lease, with right to payment if the property is sold. That is, they can’t be asked to leave early if they stay in the terms of the lease (a contract with the freeholder who actually owns the property, allowing the leaseholder to make use of the property) and they have legal protection on the tenancy, as well as right to payment if it’s sold.

This means that the “owner” of a share can face legal “possession proceedings” on grounds including rent arrears, subletting, or nuisance behaviour. Possession proceedings in this context are a legal challenge from the housing association that owns the space that can result in loss of the property without repayment.

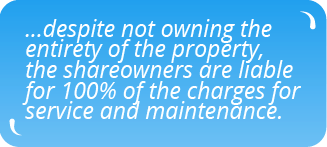

Further to this, despite not owning the entirety of the property, the shareowners are liable for 100% of the charges for service and maintenance. If the building is old, this might be significant over the course of a short time, and it can vary drastically. While all the purchasing costs are lower up front, in the long term there’s the possibility that these costs may add up to more than the total cost of the property.

What affect does this have on buying future properties?

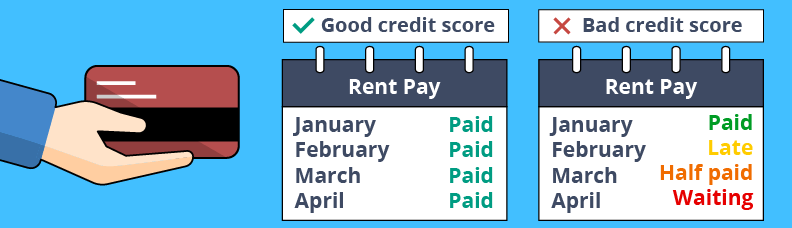

Becoming a shared ownership buyer has no direct effect on your attempts to purchase future property. However, as with any purchase, if you make it with a mortgage, it may have long-term effects on your credit. If you keep up payments, this will contribute positively, while missing payments will negatively impact your credit score.

Additionally, immediately following taking on a mortgage, your credit will worsen until it is proved that you can keep up payments, as with any property purchase.

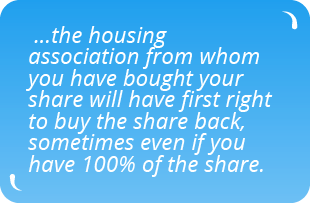

If you want to sell your shared ownership home, there are often difficulties. In many cases, the housing association from whom you have bought your share will have first right to buy the share back, sometimes even if you have 100% of the share. They may also be entitled to manage its sale, such that you are unable to do so yourself.

If you are able to sell it yourself, you will also have to sell it as a shared ownership property, which can reduce the number of buyers available.

Will the house ever be yours?

While the share purchased can be between 25% and 75% of the full property, through a system called “staircasing”, in which the buyer purchases an increased share of the property, they can ultimately purchase 100% of the property and own it outright. This might involve increasing their mortgage.

However, it is also worth noting that shared ownership scheme homes are exclusively leasehold. What this means is that while buyers will “own” the property when they have 100% of the share, they own it only on lease from the “freeholder”, that is, they only own the contractual rights to the property on “lease” from the freeholder, not the actual property itself.

The lease might last a few years or 999 years, but at the end, the lease falls back to the freeholder. This won’t necessarily mean you’re required to leave or that your tenancy ends, and you may be able to extent the lease or buy the freehold, but there’s also the option for the freeholder to start the process of having you end your tenancy.

Generally, leaseholds are extensive and will outlast your tenancy in the house, but it’s important to note both the time limits on the lease and the requirements it imposes to avoid facing legal proceedings requiring you to leave the property. This might apply at the end of the lease or if you breach the terms of the lease itself (such as not paying the ground tax or subletting when it’s not permitted).

What are the limitations of the scheme

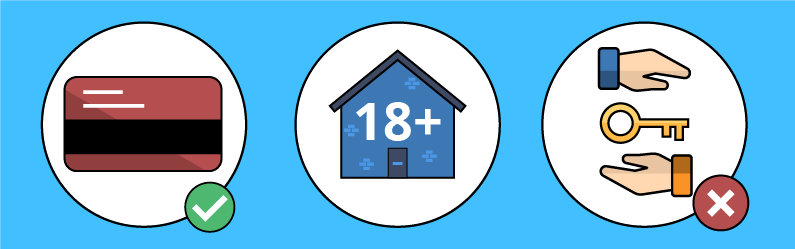

In order to be eligible for the scheme, you must meet certain criteria:

You must be at least 18 years old.

If you live outside of London, your annual household income must be less than £80,000, while if you live in London, it must less than £90,000.

You should not already own a home, or if you do, you must be in the process of selling it.

You cannot be able to afford to buy a home that meets your housing needs (such as meeting disability and family size - requirements) on the open market.

You must be able to show that you are not in rent or mortgage arrears.

You must have a good credit history and be able to afford the regular payments and costs of buying a home.

There are some limitations on the scheme itself, notably that you are only able to purchase a shared ownership home from a housing association. You are not able to purchase a given house through shared ownership means unless it is owned and offered in this way by such an association

You also can’t sublet the shared ownership home – as part of the government’s Help-to-Buy initiative, you have to live in the home you’re purchasing.

Shared ownership homes are also, as mentioned, always leasehold, so even if it is owned completely, it is only a contract that means they may use the property on lease from the freeholder.

The freeholder is responsible for common parts of the property, but the leaseholder is responsible for maintenance, annual service charges, and a share of the insurance. There is also an annual ground rent they must pay to the freeholder, and they have to seek permission if they wish to conduct major work on the property.

There may be further restrictions on the lease even after the home is yours, including not subletting or not owning pets.

How much equity do you actually get, and what does this mean?

Shared ownership allows a buyer to purchase a 25% – 75% share in a property. However, until they own 100% of the share, the buyer does not actually own any property and therefore does not own any equity.

Shared ownership should also not be confused with a shared equity scheme. Shared equity is a government help-to-buy scheme in which the government provides a loan up to 20% of the cost of the home, with the mortgage to be paid on the remaining figure after a 5% deposit. This results in the buyer owning the home, where shared ownership does not.

In Review

Shared ownership offers a good way to significantly reduce upfront costs, but it can also come with a number of limitations and disadvantages, particularly when it comes to resale and the terms of the lease ownership. Make sure that shared ownership meets your needs before diving in!