Inside TotallyMoney

A quick update from us

With the first few months of the year whizzing by, I wanted to take you through a few updates, share some highlights, and to let you know what we’ve got coming up.

Before I get into that though, it’s worth giving some context to what we’re seeing in the market. Following a period of caution, loans eligibility is now back to similar levels as October last year, having recovered by 9% from a low in December.

Credit card eligibility, however, has dipped by 3% during the same period. There’s good news for eligible customers though, who saw 4% higher pre-approval rates in the first quarter of this year than the last quarter of 2022. The result is that a massive 93% of eligible credit card customers now have a pre-approved offer on TotallyMoney.

However, the majority of customers across cards and loans are still not seeing any eligible offers, which represents a significant opportunity for lenders to expand and plug these gaps for the under-served. For more information, please reach out to your commercial contact.

Now on to what we’re up to.

Improvements to service

Inflation remains at sky-high levels, meaning that our service provides even greater value now, than ever before. In addition, our data shows that people who check their credit report have a better credit score, which is key to our work in helping the UK’s 20 million under-served adults climb towards their financial goals.

We’re constantly improving our proposition, tweaking performance, and giving people more reasons to keep coming back. In January this year, we saw our biggest month ever for active users, up almost 20% year-on-year. Performance stayed strong across the first quarter and was almost 10% up on 2022.

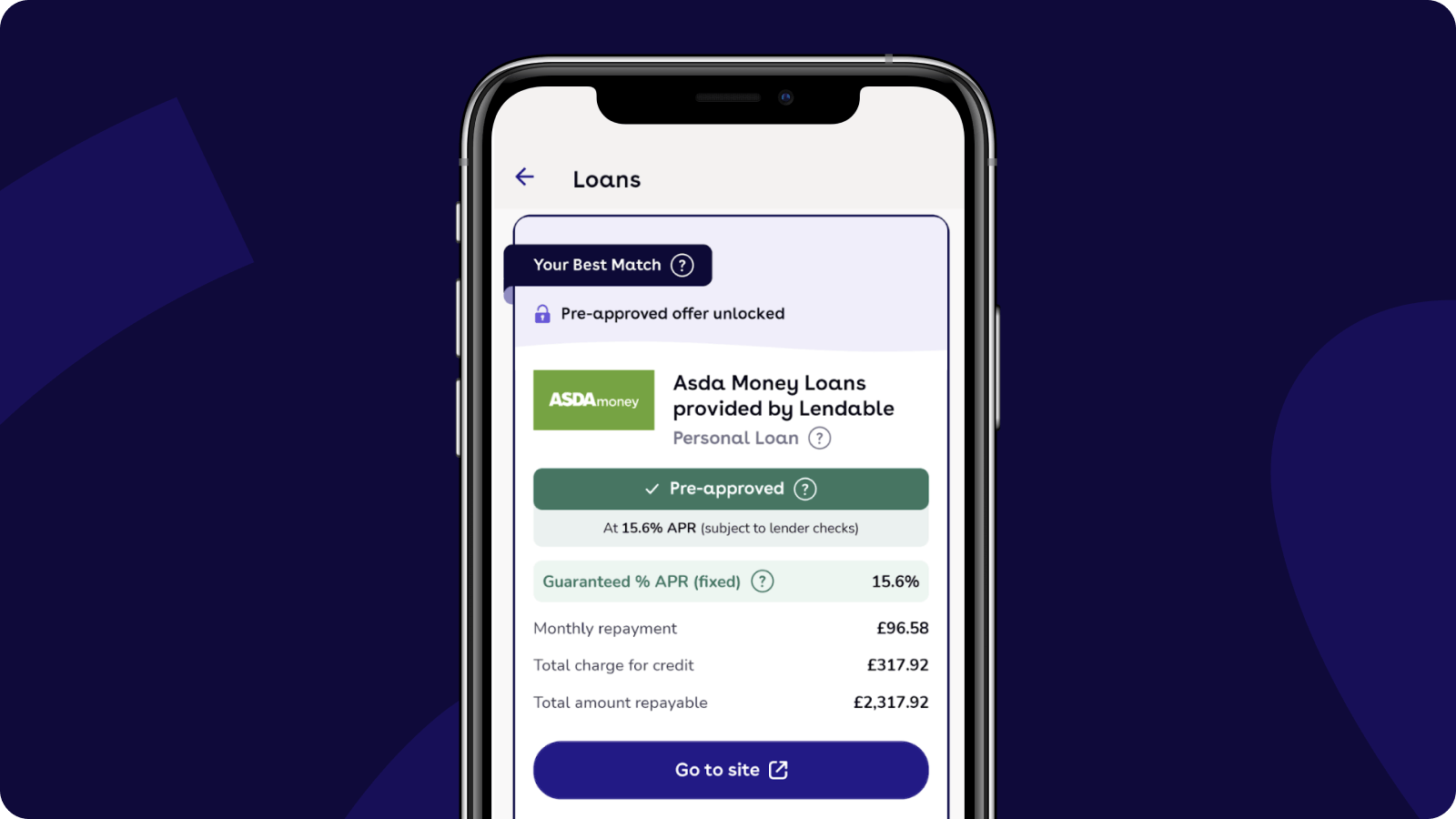

Of the monthly active users, we saw an increase in the proportion of app users from 30% in January to over 35% in March and are continuing to hit milestone figures every month. This is testament to the team and their continuous development of our app, which includes the recent launch of the eligibility hub, and the work carried out on the native app journey for credit card customers, while enabling push notifications and deep linking

Making bad credit scores history

Our biggest service improvement in recent weeks was the score history feature. At TotallyMoney, we’re always listening to feedback so we can continue to improve our service — motivated by our core value “Build. Measure. Learn.”

Each month, a considerable number of queries come through to our Customer Operations team from those who want to know why their score has changed over time. And we recognise that it’s important for people to understand their past financial behaviour so they can move towards a future of more choices.

We overhauled the existing version, so it now lets you explore six years of data. This provides a clear understanding of score fluctuations, pinpointing the reasons for changes, and identifying areas for improvement.

Our research has found that 77% of customers consider credit score improvement as 'very' or 'extremely important' to them. With that in mind, this new update should drive considerable value, and further improvement in user engagement.

Make sure you're using the latest version of our app and try it for yourself!

Rolling out open banking

Last year, our open banking partner, Bud, produced research which found that UK lenders declined almost 2 million loan applications due to thin files — and that 80% of them could have been accepted without impacting risk appetite.

With our focus on the UK’s 20 million under-served adults, this offers a real opportunity for our partners, using open banking data to provide better affordability insights to make more accurate lending decisions.

So in 2022, we delivered the capability to pass through customer open banking data at point of quote, to our partners. Please reach out to your commercial contact if you’re in a position to receive TotallyMoney open banking data for decisioning, or if you’d like to talk to us for more details around integration and the opportunities open banking provides.

We’re launching a new app feature soon which will put our customers in control of their own open banking data, providing real time insights to help them better understand their finances. Keep your eyes peeled.

Out in the wild

Following FTT Lending 3.0 where Strategic Operations Director Gabrielle Gleeson was joined by George Dunning, Co-Founder of Bud, we also attended the Innovate Finance Global Summit earlier this month where our CEO, Alastair Douglas, joined a panel to discuss how open data can be used to create better customer outcomes. In addition, General Counsel, Sharon Evans was joined by Alex Marsh of Klarna and Michael Saadat of Block, where they discussed the growth of buy-now-pay-later, the journey to regulation of BNPL and the latest government proposals.

I also attended Credit Strategy’s Credit Summit, hosted by Equifax, where I joined a panel to discuss how open banking can be used to tackle the cost of living crisis. It was great to catch up and see some of you at these events, including the AltFi Festival of Finance.

Anyway, that’s it from me, for now. Do get in touch if you have any questions on the above, or anything else.

All the best,

Charlie Evans

Head of Commercial