Could a Help to Buy ISA get you on the property ladder?

George Osborne’s Help to Buy ISA is a tax-free top-up designed to help first-time buyers. But it may not be enough for everyone.

For anyone hoping to get a foothold on the property ladder, the Help to Buy ISA announced by George Osborne in the 2015 Budget and set to launch on 1 December appears to offer a ray of hope.

To qualify for the scheme, you must save between £1,600 and £12,000 into a five-year ISA. When you come to buy a property, you’ll receive a 25% top-up from the Government – for every £200 you put away each month you get an additional £50 tax free.

If you make the maximum allowable contributions over the full five years, you will have £15,000 towards a deposit, or £30,000 if you and your partner choose to both save and buy together.

That sounds like a lot of money, but is it enough to realistically buy a flat in five years’ time? Use our interactive widget to see if you’ll have saved enough to buy in your area.

Can the Help to Buy ISA help you buy?

Where do you hope to buy?

Are you buying on your own or as part of a couple?

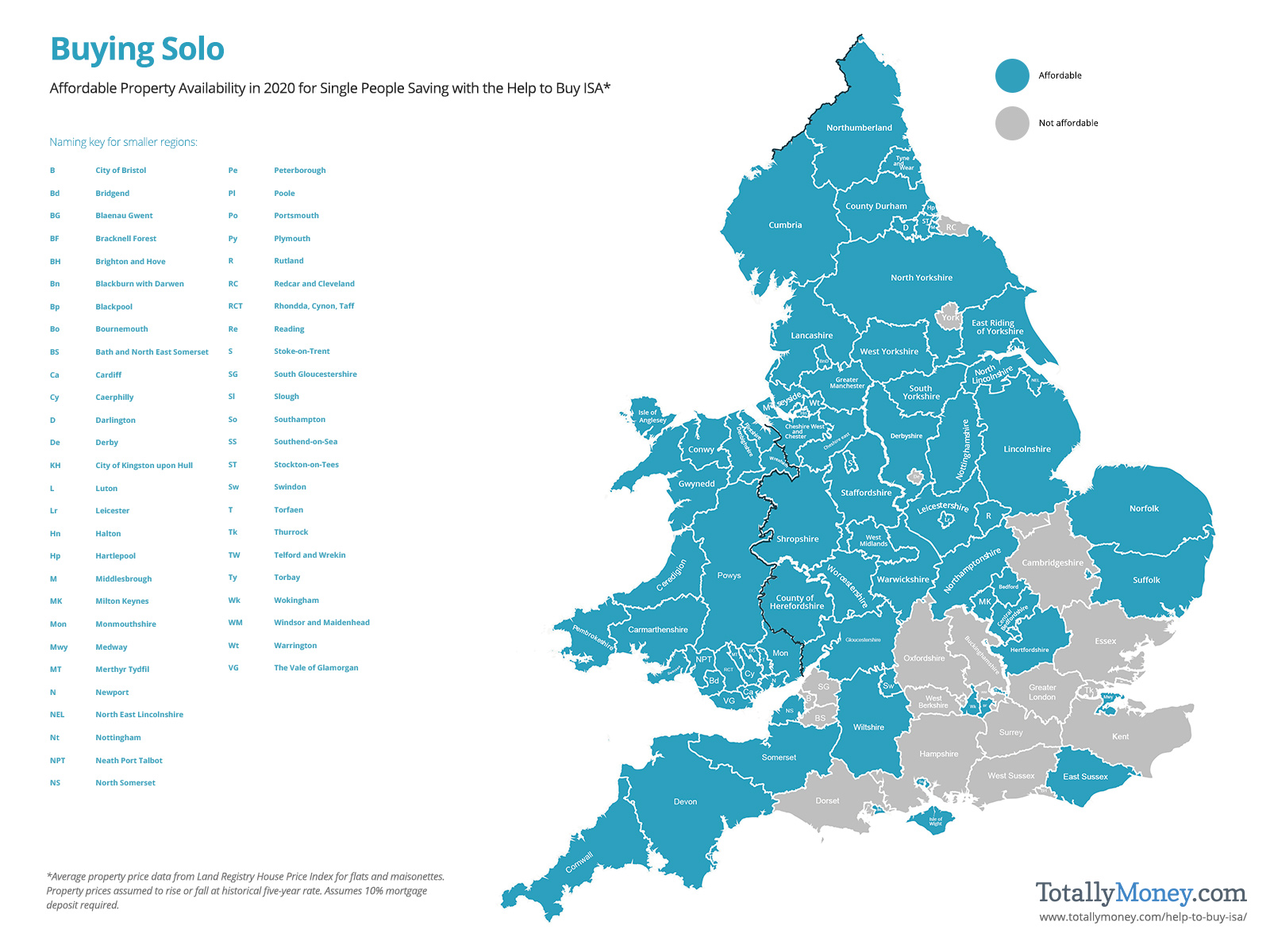

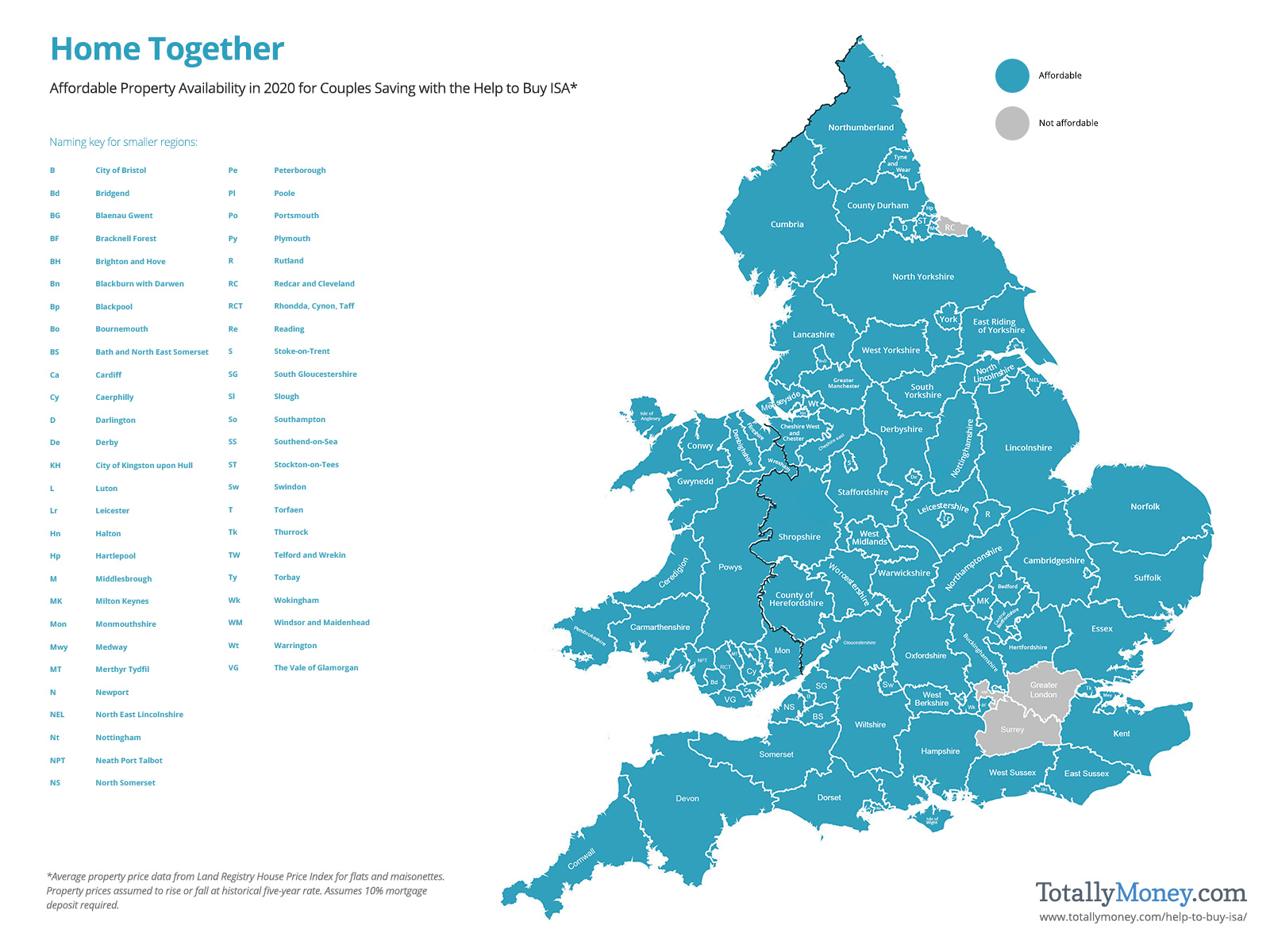

Across England & Wales there is a clear divide between the winners and losers in the starter home stakes. And the picture is similar whether you are single or looking to buy with your partner.

For those in the Midlands and North, it appears the Government’s tax-free top up could offer a genuine helping hand.

But if you want to buy in the South East, you better get swiping on Tinder. Single buyers using the Help to Buy ISA will be unable to purchase anything from Cambridgeshire to Dorset in 5 years’ time.

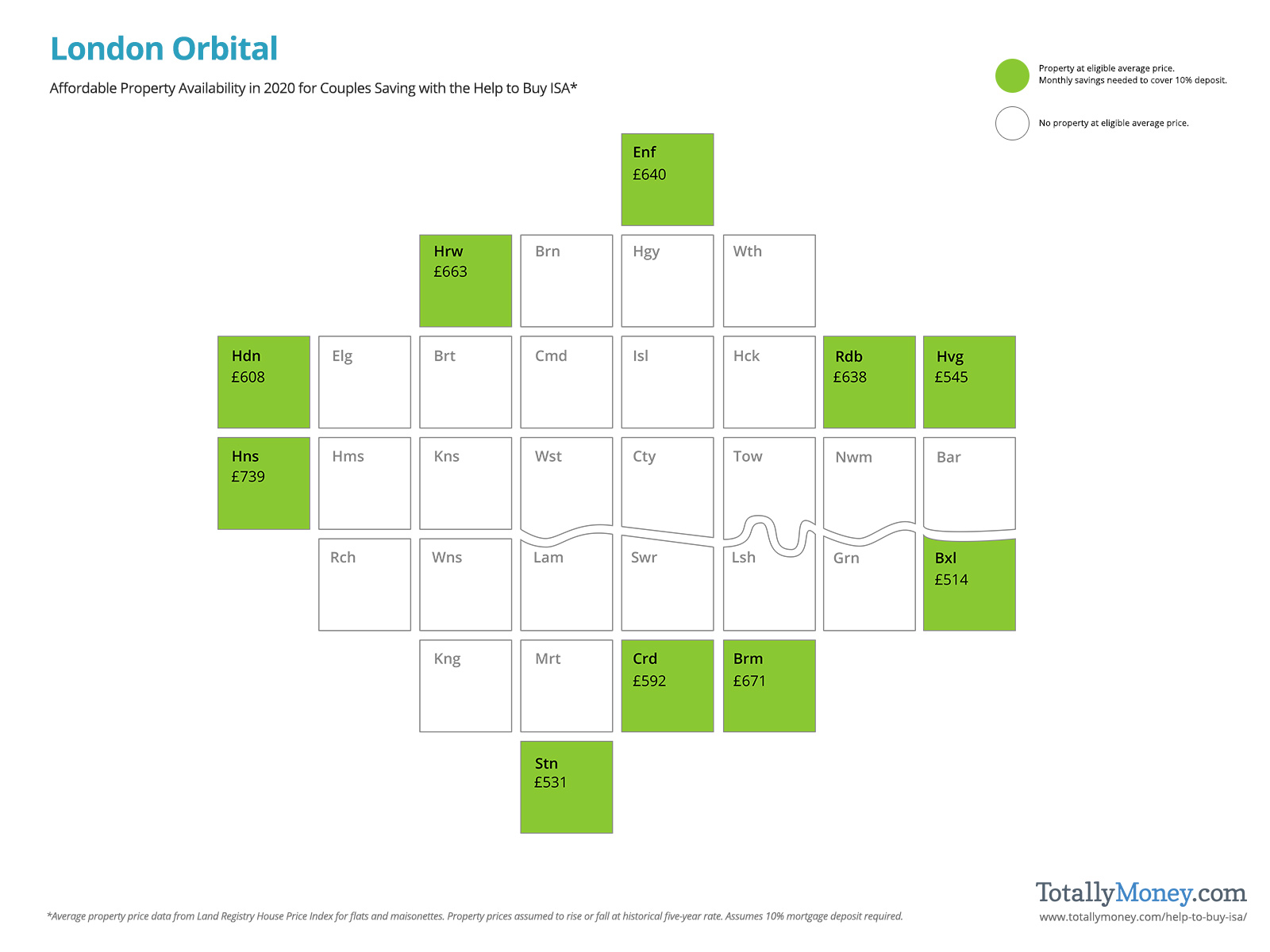

Londoners are the real losers of the scheme, with the only properties under £450k set to be on the outskirts – Redbridge, in Zone 4, and others all in Zone 5 and 6. Only 10 out of London’s 32 boroughs will be affordable for single first-time buyers.

To many, it may feel that the Help to Buy ISA scheme is in fact a headline-grabbing move rather than a solution to the housing crisis.

Our research demonstrates that while the Government’s initiative is a helping hand in some areas of England and Wales, what Generation Rent really needs is a leg up.

*Average property price data from Land Registry House Price Index for flats and maisonettes. Property prices assumed to rise or fall at historical five-year rate. Assumes 10% mortgage deposit required.